View Partial Release Of Lien Background. Irc § 7432 gives taxpayers the right to sue the federal government if the service knowingly or negligently fails to request a lien release be manually input to als, prepare form 13794, request for release or partial release of notice of federal tax lien. The direct contractor, subcontractor or materials supplier would then have the reduced amount adjusted accordingly, while still maintaining the right to the lien until all funds have been received in full.

Fill, sign and send anytime, anywhere, from any device with pdffiller.

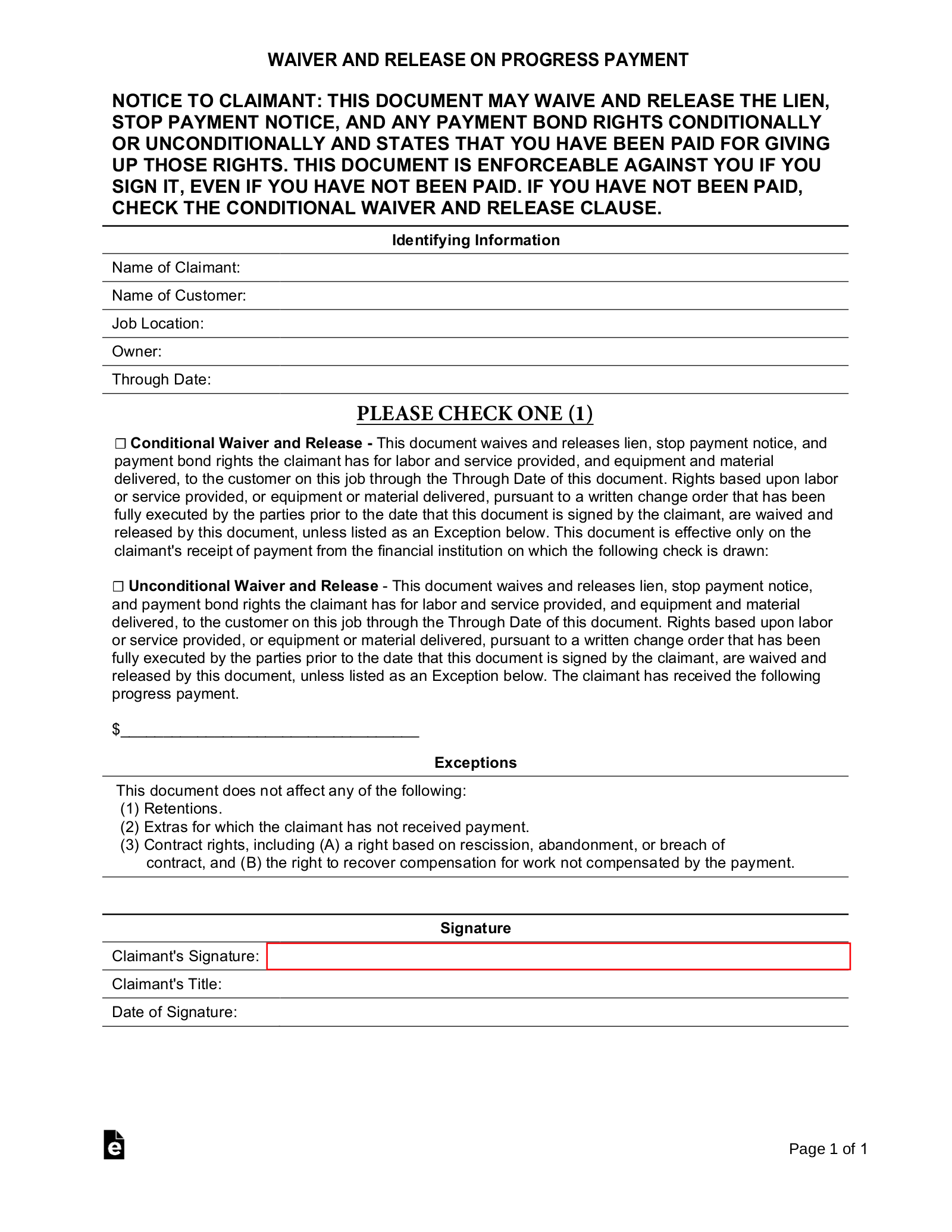

Shown below (check one of the following) the county clerk shall enter on the judgment index a notation of such full or partial release of lien in each. Generally, the priority of liens is determined by the order of the recording date. The direct contractor, subcontractor or materials supplier would then have the reduced amount adjusted accordingly, while still maintaining the right to the lien until all funds have been received in full. Whether you are an owner paying a general contractor or a general contractor paying a determining whether the lien release you are signing is a final or partial lien waiver can sometimes be difficult.